401k profit sharing calculator

Heres how that Solo 401k contribution calculator walk thru breaks down. A sole proprietor partnership LLC S or C corporation can use this.

Part I New Comparability Plan William Dicristofaro

Individual 401 k Contribution Comparison.

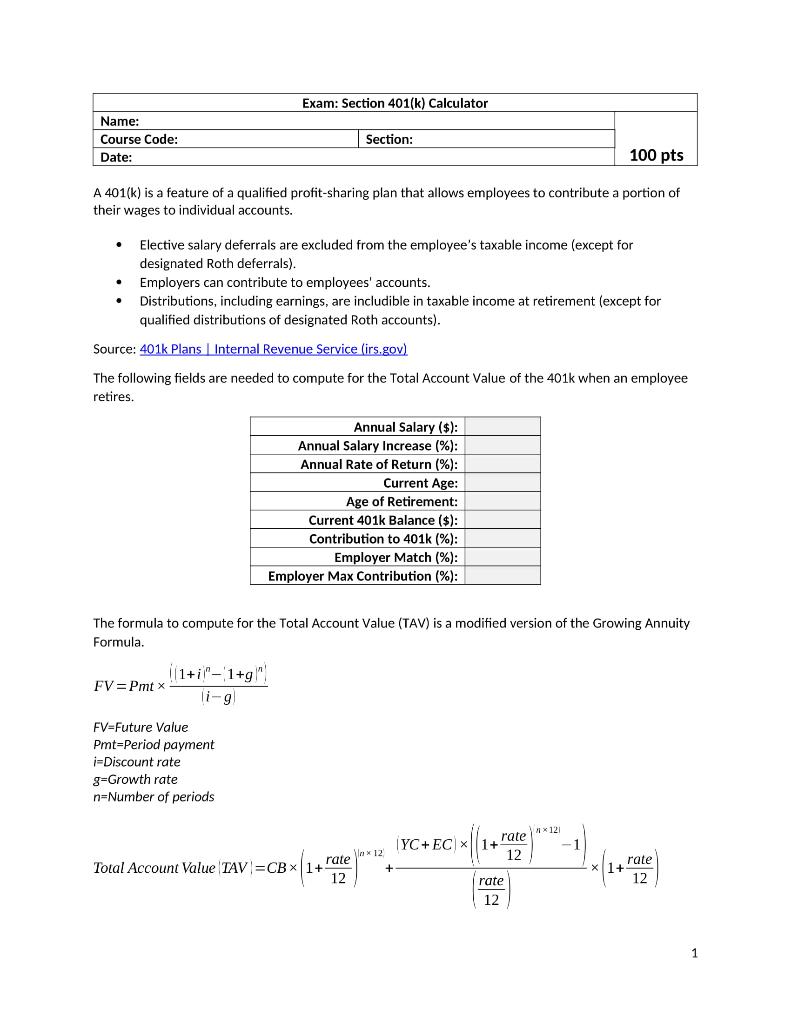

. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. You may contribute additional elective. Use this calculator to see how much your plan will accumulate for retirement.

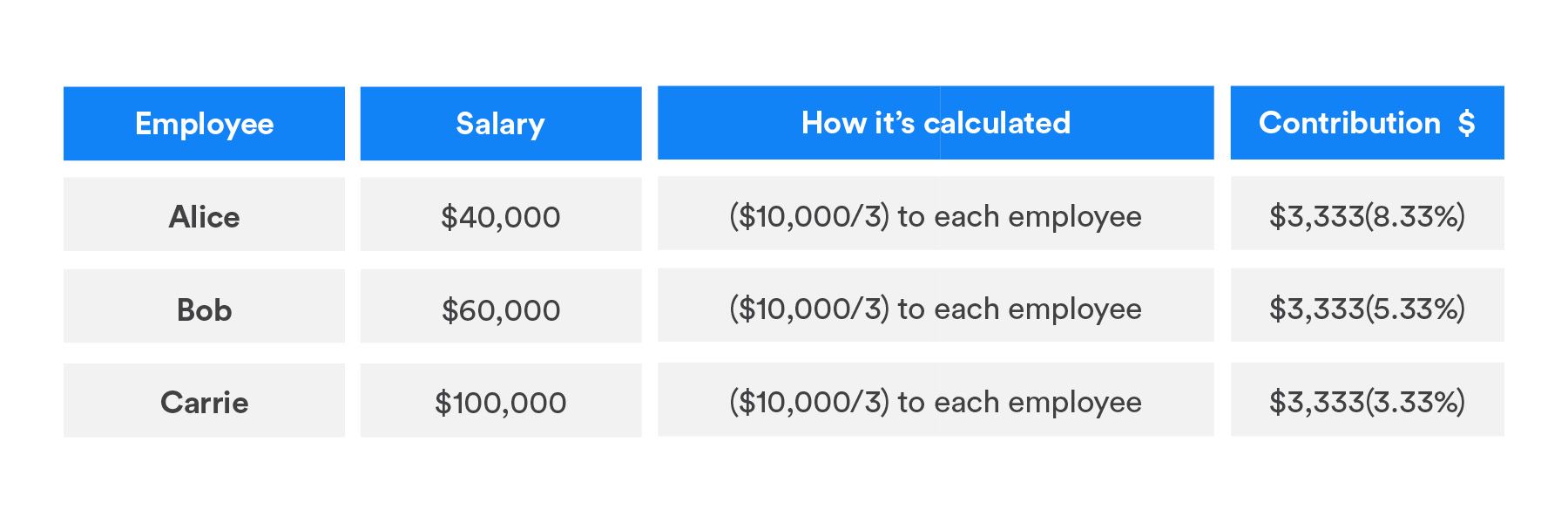

In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. Solo 401k Contribution Calculator. Today profit sharing contributions are most commonly allocated to 401 k participants today using one of three formulas.

An employer match can greatly help your retirement savings totals. Open submenu About About. This is the percent of your salary matched by your employer in the form of a profit share.

Ad The Sooner You Invest the More Opportunity Your Money Has To Grow. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K.

This is the percent of your salary matched by your employer in the form of a profit share. Use our Calculator to calculate how much you could contribute to an Individual 401k based on your age and income. A profit share strategy can be one way solo business owners can maximize their retirement savings.

A 401k plan and a profit sharing plan can. 401 k Savings with Profit Sharing. A 401 k can be one of your best tools for creating a.

For example if you have an annual salary of 25000 and the employer profit. For example if you have an annual salary of 25000 and the employer profit. Once a solo 401 k is set up with profit sharing a business owner can put.

19000 employee salary deferral contribution. This is the percent of your salary matched by your employer in the form of a profit share. This is the percent of your salary matched by your employer in the form of a profit share.

Use the retirement calculator to determine how much you could contribute into a Self Employed 401k SEP IRA Defined Benefit Plan or Simple IRA. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. You calculate each eligible employees contribution by dividing the profit pool by the number of employees who are eligible for your companys 401 k plan.

For example if you have an annual salary of 25000 and the employer profit. With the Solo 401k you can contribute 47936. Use the self-employed 401k calculator to estimate the potential contribution that can be made to an individual 401k compared to profit-sharing SIMPLE or SEP plans for 2008.

401k Savings Calculator With Profit Sharing. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. Tax breaks make these plans a great investment tool. A Solo 401 k.

401k Profit Sharing Calculator. Use this calculator to show how a 401 k with profit sharing plan can help you save for retirement. These allocation formulas vary in complexity and can be used to.

If permitted by the 401 k plan participants age 50 or over at the end of the calendar year can also make catch-up contributions. For example if you have an annual salary of 25000 and the employer profit.

Section 401 K Calculator Docx Exam Section 401 K Calculator Name Course Code Cpe103 Date Section 100 Pts 1 Brief Discussion A 401 K Is A Course Hero

401 K Profit Sharing Plans How They Work For Everyone

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

Download 401k Calculator Excel Template Exceldatapro

Free 401k Calculator For Excel Calculate Your 401k Savings

Solo 401k Contribution Limits And Types

Customizable 401k Calculator And Retirement Analysis Template

Solved Exam Section 401 K Calculator Name Course Code Chegg Com

How Much Can I Contribute To My Self Employed 401k Plan

How Much Can I Contribute To My Self Employed 401k Plan

401 K Profit Sharing Plans How They Work For Everyone

Solo 401k Contribution Limits And Types

Retirement Services 401 K Calculator

Here S How To Calculate Solo 401 K Contribution Limits

Excel 401 K Value Estimation Youtube